Whether you are looking for a personal fuel card to help you keep your vehicles in shape and your expenses under control or you are looking to better manage your business, Shell offers a variety of credit cards to help you save money on fuel purchase and provide detailed fuel reporting.

Shell Fleet Credit Card

Key Benefits:

No annual fee

No minimum purchase.

Why fleet managers prefer it.

• Easily monitor transactions, review statements, download reports, update account profiles, submit questions and requests online, 24/7. FREE

• Ability to restrict purchases to fuel only, OR

• The Executive option allows the flexibility of purchasing convenience store items such as food and beverages, in addition to petroleum products and services.

• One Station Card option allows purchases only at the service station of your choice.

• Quality gasoline for your vehicles.

• All vehicle-related costs are reported in a simplified monthly statement that itemizes each driver's fuel and vehicle operating expenses.

• No service charges or annual fee; no minimum purchases.

• No complex billing.

Why drivers like it.

• No fuel/vehicle expense reports to file.

• Accepted at thousands of Shell stations and participating Jiffy Lube® locations nationwide.

• Car wash and/or food marts at most locations.

• 24-hour service at most locations.

Limit or expand its usage.

• Confine purchases to one location with the One Station option

• Limit card purchases to fuel only

• Permit purchase of convenience store items with the Executive option

Shell Fleet Plus Card

Key Benefits:

•Reduced fuel costs.

•Reduce fleet fuel costs by as much as 6¢ per gallon depending on your monthly purchases

Total number of Gallons Purchased in Billing Cycle Per Gallon Rebate

10 - 299.99 $0.0

300 - 3,499.99 $0.03

3,500 - 7,999.99 $0.04

8,000 - 9,999.99 $0.05

10,000+ $0.06

Reports you need to control costs. Get extensive management information to monitor and control fuel expenses. Itemized cost breakouts can include mileage analysis, fuel grades/prices paid, non-fuel purchase and more. Cost totals can be billed to the vehicle, company, department or customer account.

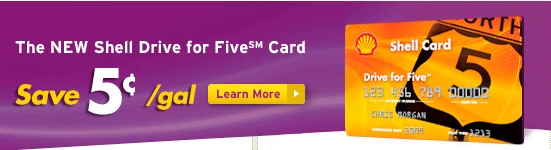

Shell Drive for Five Card

As a loyal customer you have the opportunity to save 5¢ per gallon on Shell Nitrogen Enriched gasolines or Shell diesel. Purchase at least 45 gallons of Shell gasoline or Shell diesel in a month and save 5¢ per gallon purchased that month - up to 100 gallons. You will receive statement credits based upon fuel purchases made with your Shell Drive for Five card. When you use the Shell Drive for FiveSM Card, you can always count on the following benefits too.

Key Benefits:

•Flexible Terms

•Keep track of your gasoline purchases separately

•$0 Liability on unauthorized charges.

•Pay at the pump convenience

•Manage your account online

•Citi® Identity Theft Solutions

Option to revolve or pay in full.Perfect for tracking your budget. Also helps keep your credit open for "big-ticket" purchases.Get the security of staying with your vehicle and saving time with "swipe and pump."Review unbilled charges, current statements, make and schedule your payments online.Because your Shell Card is issued by Citi, you'll get specialized assistance to help you if you ever become a victim of identity theft.

Shell Select Member Card

Key Benefits:

Cash back on hotels, airlines and car rentals.

•10% cash back on hotels and motels

Stay at Hilton, Ramada, Holiday Inn, or other well-known hotels and get 10% cash back as a member when booked through the Select Member Reservation Center.

•5% cash back on airlines1

Every domestic airline ticket booked through the Select Member Reservation Center gives you 5% cash back—airlines like United, American and all other U.S. airlines. (Excludes Hawaii & Puerto Rico)

•5% cash back on car rentals1

Get 5% cash back on every rental from Hertz, Avis, National and other major car rental companies booked through the Select Member Reservation Center.

•Select Member's toll-free number Call us 24/7.

•Travel Reservation Services.

Guaranteed lowest prices.

•Hotel discounts.

Approximately 5,000 hotels at half price; another 8,000 at 30% discount. Insurance protection

•$200,000 flight insurance.

•$25,000 common carrier insurance.

•$1,000 credit life insurance. $1,000 emergency cash and/or prepaid airline ticket.

•Up to $1,000 emergency cash.

•Up to $1,000 in airline tickets.

•Credit card registration service.

•Shell Select Member recognition decals

•Toll-free weather service

•24-hour emergency message center

•Computer generating trip routing.

Stay in tune!